Introduction to Meta Stock

Meta Platforms Inc. (formerly Facebook) is one of the most influential tech giants in the world. Since rebranding in 2021, Meta has aggressively invested in the metaverse, artificial intelligence, and augmented reality. This article will provide a complete guide to Meta stock, its performance, and its investment potential.

Meta Stock Performance

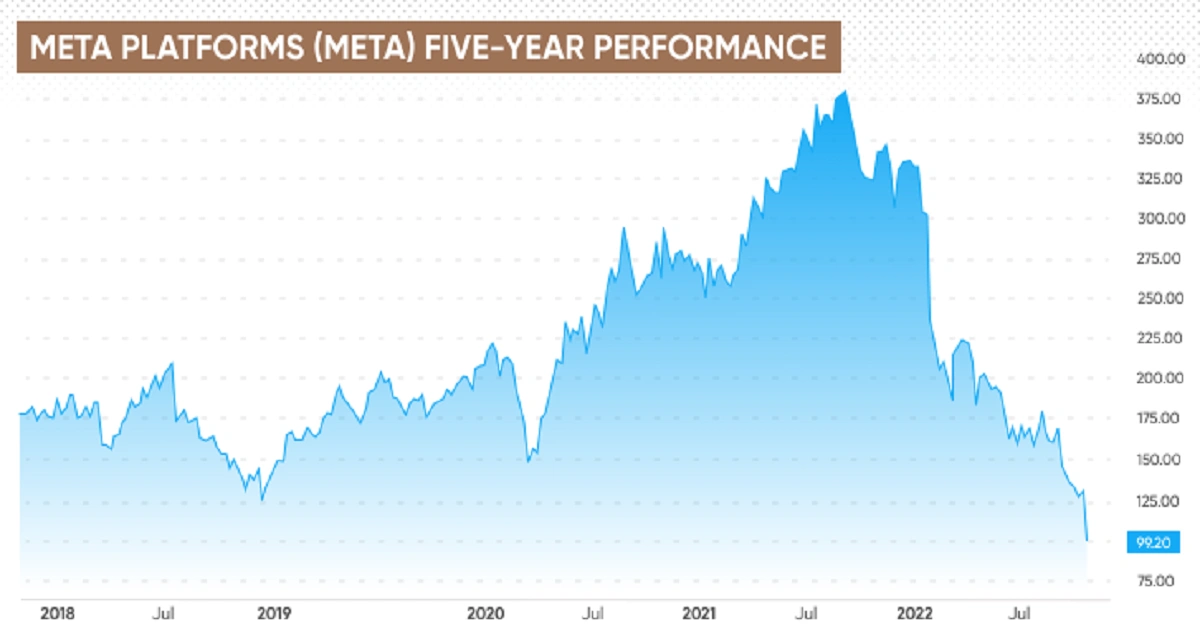

Historical Performance and Growth

Meta stock has shown remarkable growth since its IPO in 2012. Many doubted its profitability initially, but the company quickly proved skeptics wrong by dominating the digital advertising space. The stock saw a significant rise, peaking during the tech boom of the 2020s.

Current Market Trends

Meta’s stock has experienced volatility, impacted by changes in digital ad spending, privacy regulations, and competition from platforms like TikTok. However, with increasing investments in AI and the metaverse, the company is aiming for long-term expansion.

Financial Highlights and Key Metrics

- Market Capitalization: Over $1 Trillion

- Revenue: Primarily from digital advertising (over 90%)

- Price-to-Earnings (P/E) Ratio: Competitive within the tech sector

- Dividend Policy: No dividends, focusing on reinvestment

Factors Affecting Meta Price

Revenue Streams and Business Model

Meta stock generates revenue primarily from digital advertising across platforms like Facebook, Instagram, and WhatsApp. However, it is diversifying into AI, virtual reality, and hardware products.

User Growth and Engagement

Despite competition, Meta still boasts billions of active users, making it an advertising powerhouse. Any slowdown in user growth can impact investor confidence.

Ad Revenue and Market Competition

With Apple’s privacy changes affecting ad tracking, Meta has faced challenges in targeting ads. Competitors like Google and TikTok are also vying for ad dollars.

Investments in the Metaverse and AI

Meta’s pivot to the metaverse is a long-term gamble. Billions have been spent on Reality Labs, but widespread adoption is still uncertain.

Regulatory Challenges and Risks

Governments worldwide are scrutinizing Meta stock for data privacy, antitrust issues, and misinformation. Regulatory hurdles could impact profitability.

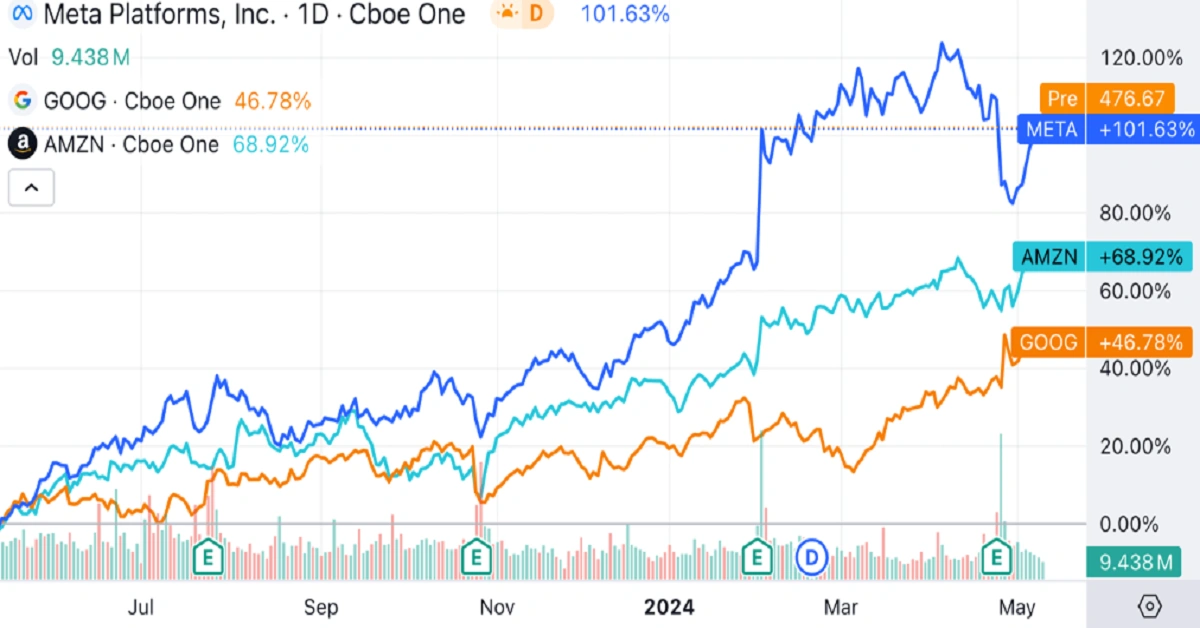

Meta Stock vs. Competitors

Meta vs. Google (Alphabet)

Google has a stronger search advertising business, but Meta leads in social media ads.

Meta vs. Apple

Apple’s privacy changes have affected Meta’s ad revenue, making it a direct competitor in digital privacy.

Meta vs. Amazon

Amazon is expanding in digital advertising, posing a new challenge to Meta’s dominance.

Meta vs. Microsoft

Microsoft is a key player in AI and cloud computing, areas where Meta is trying to expand.

Should You Invest in Meta Stock?

Pros of Investing in Meta Stock

- Strong digital advertising business

- High user engagement across platforms

- Expanding into AI and the metaverse

- Strong financial position

Cons and Risks Involved

- Market volatility and stock price fluctuations

- Heavy spending on unproven metaverse technology

- Privacy and regulatory concerns

Expert Opinions and Analyst Ratings

Most analysts remain bullish on Meta, citing its advertising dominance and future growth potential. However, some warn about the risks of its metaverse strategy.

How to Buy Meta Stock

Choosing the Right Brokerage

Meta stock is available on major stock exchanges like NASDAQ. Choose a brokerage that offers low fees and easy trading options.

Steps to Buy Meta Stock

- Open a brokerage account

- Fund your account

- Search for Meta stock (Ticker: META)

- Choose the number of shares

- Execute the purchase

Tips for Beginners

- Start with a small investment

- Monitor financial reports and earnings calls

- Stay updated on industry trends

Future Outlook for Meta

Growth Potential in the Metaverse

If the metaverse vision succeeds, Meta could become a trillion-dollar leader in digital experiences.

AI and Virtual Reality Expansion

Meta’s AI-powered ad tools and virtual reality products could boost revenue streams significantly.

Long-Term Stock Price Predictions

While short-term volatility exists, many analysts believe Meta’s long-term growth potential is strong.

Conclusion

Meta stock remains a dominant force in the tech and advertising industry. While the company faces challenges, its expansion into AI and the metaverse could offer significant returns for long-term investors. As always, conduct thorough research before investing.